What’s the Difference Between IRR and Equity Multiple?

Topic: BASIC KNOWLEDGE, RETURNS • By: Michael Lewis • 01-16-2019

Returns are the basic metric for evaluating the profitability of a potential investment.

When you look at the stock market and see that an stock price has “fallen” by 100 points or 10%, this information is meaningless without knowing the date the stock was purchased, the buy price, the amount of stock purchased, the sale price, and the cost of the transaction in fees, taxes, and time.

Fundamentally, the investor neither gains nor loses money when a stock price fluctuates. The investor converts cash to stock at a given time and subsequently converts the stock back to cash (or to a different security). The investor pays an assortment of fees associated with the transaction which may not be simple to compute nor tabulated at the onset. The actual profitability of many publicly-available investments is unknown until after the gain or loss is realized.

Understanding returns in the context of real estate investing is no different from understanding returns in the context of any other investment. The difference is: the returns are projected in a privately-offered real estate investment.

Because you are investing in a thoroughly-vetted and underwritten real estate project, an experienced sponsor is able to provide finite expectations regarding the cash returned to the investor during the project.

An investor should have some idea of the basic terminology underlying investment returns to understand how and when profits will be realized.

Distributions – When a Business Pays Money

The definition of distribution varies depending on the context, but for purposes of almost all group real estate investments, distribution simply means the business (usually an LLC) is paying out money.

Return on Investment (ROI) – The Simple Way to Gauge an Investment Return

Return on Investment (ROI) (also called “cash on cash return”) is a simple measure of an investment’s profitability without consideration of the time value of money. The formula is: (Gain – Cost) / Cost. If you invest $100 today and receive $120 tomorrow, your ROI is 20%. Not bad! The attractiveness of ROI is it’s simplicity and ease of calculation. The downside is that ROI fails to consider that present money is more valuable than future money because present money has earning capacity. If you invest $100 today and receive $120 in ten years, your ROI is still 20%.

Internal Rate of Return – The Better Way to Gauge an Investment Return

Internal Rate of Return (IRR) is a derivative value that shows the rate of growth an investment is expected to generate over time in consideration of the fact that money now is worth more than money later.

IRR describes the compounded annual percentage rate every dollar earns while it is invested.

IRR is the same metric across different investments–which is why it is so commonly used in investing and why it is a more accurate way to gauge an investment return. That said, IRR does not describe the total cash an investment will return. This is why IRR should be used in conjunction with an investment’s ROI or Equity Multiple to provide a more complete picture of the opportunity.

Equity Multiple – ROI’s Cousin

An Equity Multiple of 2.5x means a return of $2.50 for each $1.00 invested. Easy right?

Equity Multiple is the Total Cash Distributions divided by Total Equity Invested. For example, if you invest $50,000 in a project and your cash distributions total $110,000, your equity multiple would be 2.20x. ($110,000 / $50,000) This means that, for every dollar invested, the investment firm projects a return of $2.20. This metric has from the same downsides as ROI, but is oftentimes preferred because it provides a simple cash-to-cash return.

What about Average Annual Return?

Average Annual Return is simply the arithmetic mean (average) of the yearly returns over a set period of time. It values the Y1 return the same as the Y10 returns. An obvious limitation is that AAR does not weigh the time value of money, inflation, and other realities.

Industry professionals use it, and it’s a great measure of “what” an investment pays. IRR also considers “when” the investment pays.

Always consider AAR in conjunction with IRR because the later more accurately reflects the true return of an investment–albeit in a way that’s harder to wrap your head around.

How Do I Apply This?

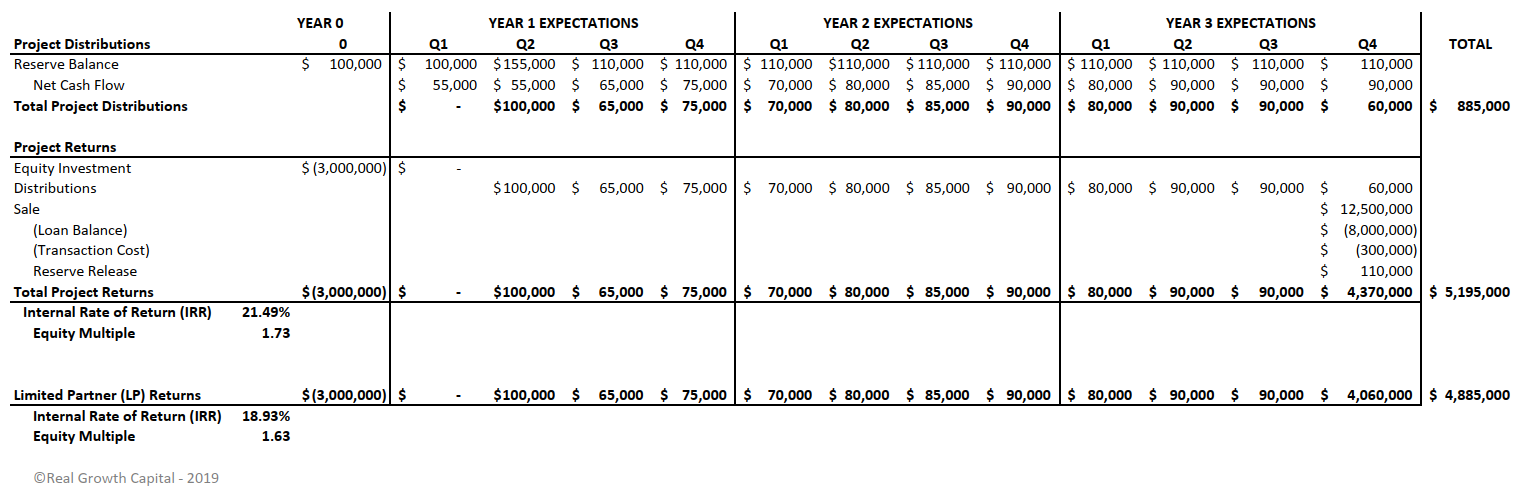

The following is an example of one of the many tables of data commonly found in a package circulated to potential investors.

In this example, a sponsor proposes the purchase of an apartment community for $10,000,000. A bank finances $8,000,000 interest-only for three years. A group of investors (alongside the sponsor) contributes $3,000,000 to fund a portion of the purchase price, renovations, and closing costs. The sponsor owns 10% of the LLC purchasing the apartment community. The investors own 90%. The apartment community will be sold at the end of Year 3 for $12,500,000.

Analyzing these numbers, the money distributed to investors each quarter is projected at the bottom of the document in the “Limited Partner (LP) Returns” row. For example, the investment will pay investors $80,000 in Year 2, Q2. This money will be split according to each investor’s pro rata share of the total invested capital. This is not a fluctuation in stock price. This is a projection of cash paid to investors quarterly.

The Limited Partner Equity Multiple is 1.63x based on this data ($4,885,000 paid to investors who contributed $3,000,000 at the start of the project). The sponsor anticipates that each investor will be paid $1.63 for every dollar invested. Limited Partner IRR is 18.93%. This is great; but considerably lower than one might expect with a return of $1.63 per dollar invested.

In the 4th Quarter of Year 3, Real Growth Capital anticipates sale of the apartment complex for $12,500,000. The bulk of the investor returns in this example are realized upon sale.

How Does an Investment that Pays $1.59 for Every Dollar Invested Have an IRR of 19%?

This is why IRR must be read in conjunction with the Equity Multiple. This is a “value add” example where Real Growth Capital renovates the property to generate more revenue and boost value. Most of the total return occurs three years after the investor contributed his capital. Every dollar invested will yield a return of $1.59, but $1.34 of that return occurs three years after the initial investment. A further example may be helpful.

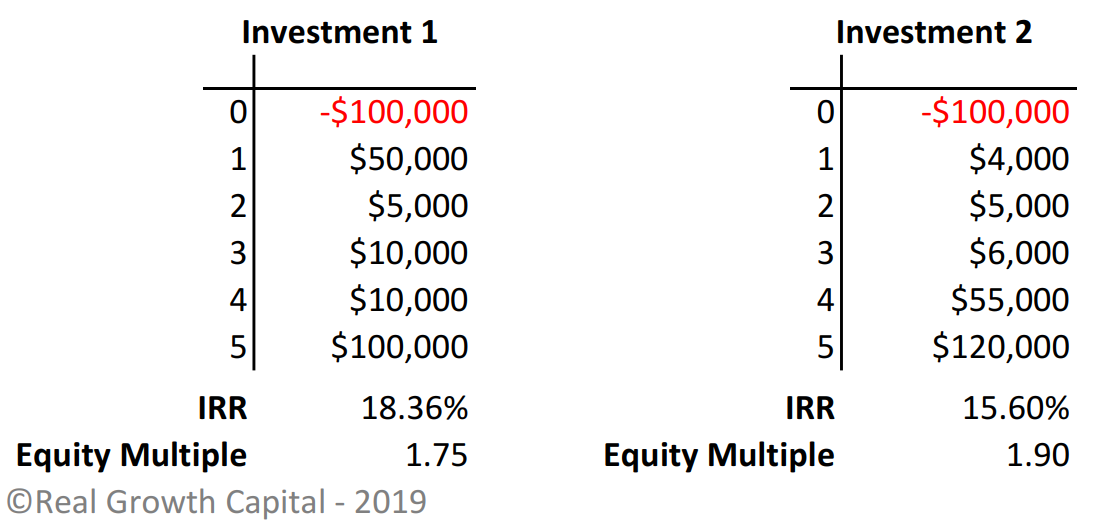

An investor has two investment opportunities. Each investment costs $100,000 and projects annual returns for five years.

Which investment is better? It depends on the investor’s goals. Investment 1 has a lower total return (Equity Multiple), but it pays half of the initial investment back in year 1. This investment might appeal to a more prolific investor who utilizes multiple streams of investment revenue and intends to promptly re-invest returns.

Investment 2 has a greater total return, but most of the return is distributed in years 4 and 5. This investment might appeal to an investor more interested in maximizing his total Return on Investment.

Real Growth Capital helps investors evaluate deals by forecasting both the IRR and Equity Multiple in all opportunities we sponsor. Returns can be described in many ways; but you should always know the anticipated IRR and Equity Multiple before investing. Remember that IRR is the compounded annual percentage rate every dollar earns while it is invested. Equity Multiple is simply the cash-on-cash return for every dollar invested.

Over five years, an IRR of just 15% will turn $1 million into $2 million. This is the secret to growing real wealth.

POSTED BY

W. Michael Lewis

Michael Lewis is a licensed attorney with more than a decade of experience advising clients before founding Real Growth Capital. His expertise includes real estate investing, financial analysis, asset management, business strategy, and negotiation.